Supporting Tidewell Foundation through your stocks, donor-advised funds, or IRA assets is simple. Just follow the steps below to make your contribution today. Your gift helps ensure that compassionate care is available to all, regardless of their ability to pay.

Making a Gift

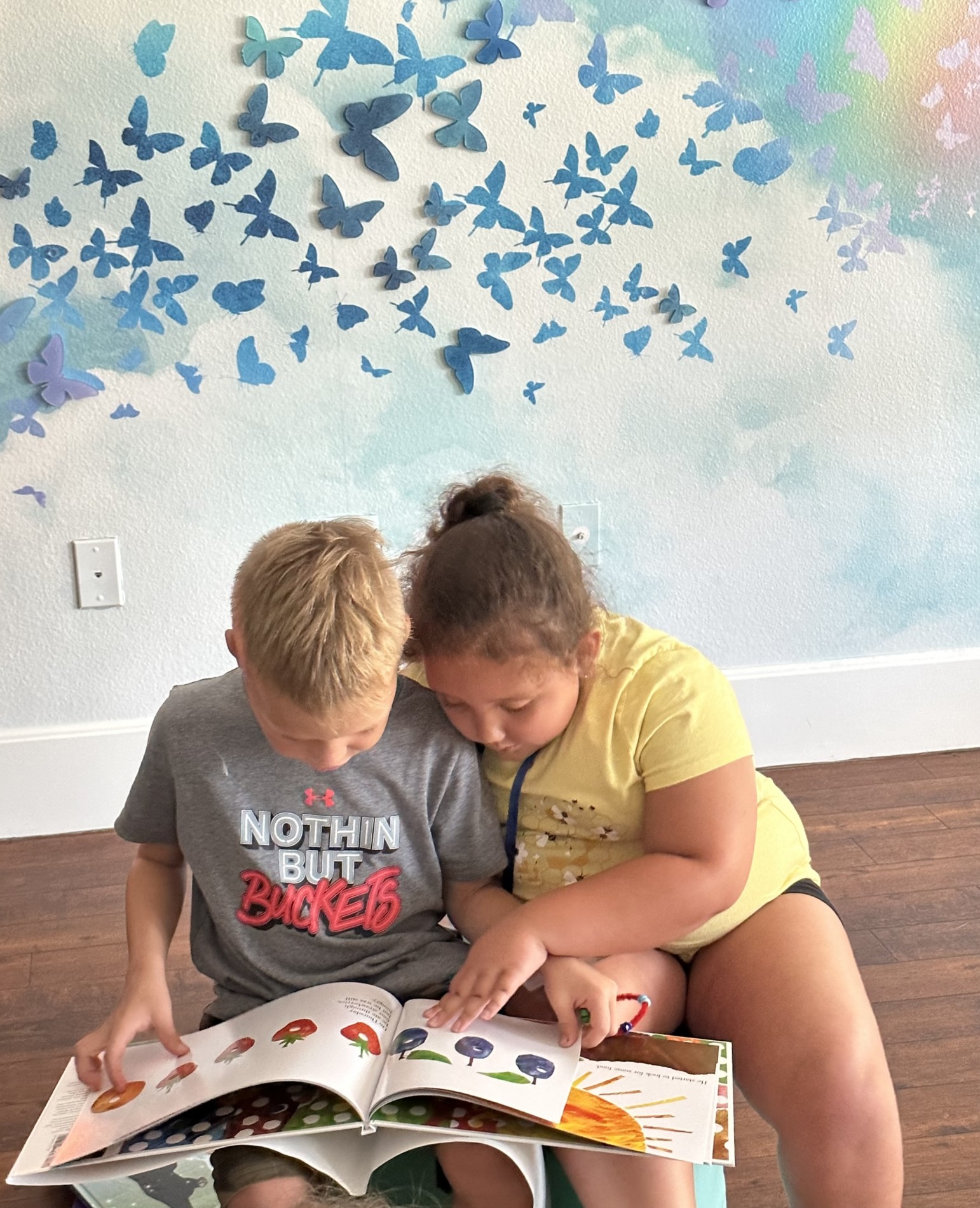

When you give to Tidewell Foundation, you’re doing more than making a donation—you’re providing comfort, dignity, and compassionate care to patients and families across Charlotte, DeSoto, Manatee, and Sarasota Counties. Every gift helps sustain and expand the programs that define Tidewell’s mission—from grief counseling and family support to specialized care for veterans and children.

There are several meaningful and tax-efficient ways you can make a difference:

-

Donor Advised Funds (DAFs): If you have a DAF account with Fidelity Charitable, Schwab Charitable, or BNY Mellon, you can easily recommend a grant.

The link provided below is for convenience only and is not an endorsement of either the linked-to entities or any products or services.

- Stock Gifts: Giving appreciated stock may offer tax benefits while supporting Tidewell’s mission.Stock Gifts

- IRA Charitable Distributions: Individuals aged 70½ and older can transfer up to $110,000 annually directly from a traditional or Roth IRA to a qualified charity, potentially reducing taxable income.

IRA Donations

Together, we can brighten lives.

Questions?

Contact Delesa Morris at (941) 735-7155 or delesamorris@tidewellfoundation.org.